Thursday, December 31, 2015

Wednesday, December 30, 2015

Friday, December 25, 2015

Thursday, December 24, 2015

Monday, December 7, 2015

Tuesday, December 1, 2015

October 2014 vs October 2015

Are you thinking about selling your home or buying a new home in 2016?

Lets work together in achieving that goal!

Tiffany Neri- Realtor Cell: 303-775-7508 Email: tiffanymneri@gmail.com

Wednesday, November 4, 2015

Thursday, October 29, 2015

Friday, October 23, 2015

Monday, October 12, 2015

Monday, October 5, 2015

Monday, August 31, 2015

Monday, August 10, 2015

Monday, July 20, 2015

Thursday, July 2, 2015

Friday, June 12, 2015

Thursday, May 7, 2015

Monday, May 4, 2015

Wednesday, April 22, 2015

Tuesday, April 7, 2015

This Month in Real Estate April 2015

Contact me if your considering selling or buying a home.

Email: tiffanymneri@gmail.com Cell: 303-775-7508

Email: tiffanymneri@gmail.com Cell: 303-775-7508

Tuesday, March 17, 2015

Free Buyer Seminar

Are you considering buying a new home or know someone that is thinking about it? Come join us tomorrow night for a free buyer seminar and credit restoration. Get all your questions answered!

Wednesday, March 11, 2015

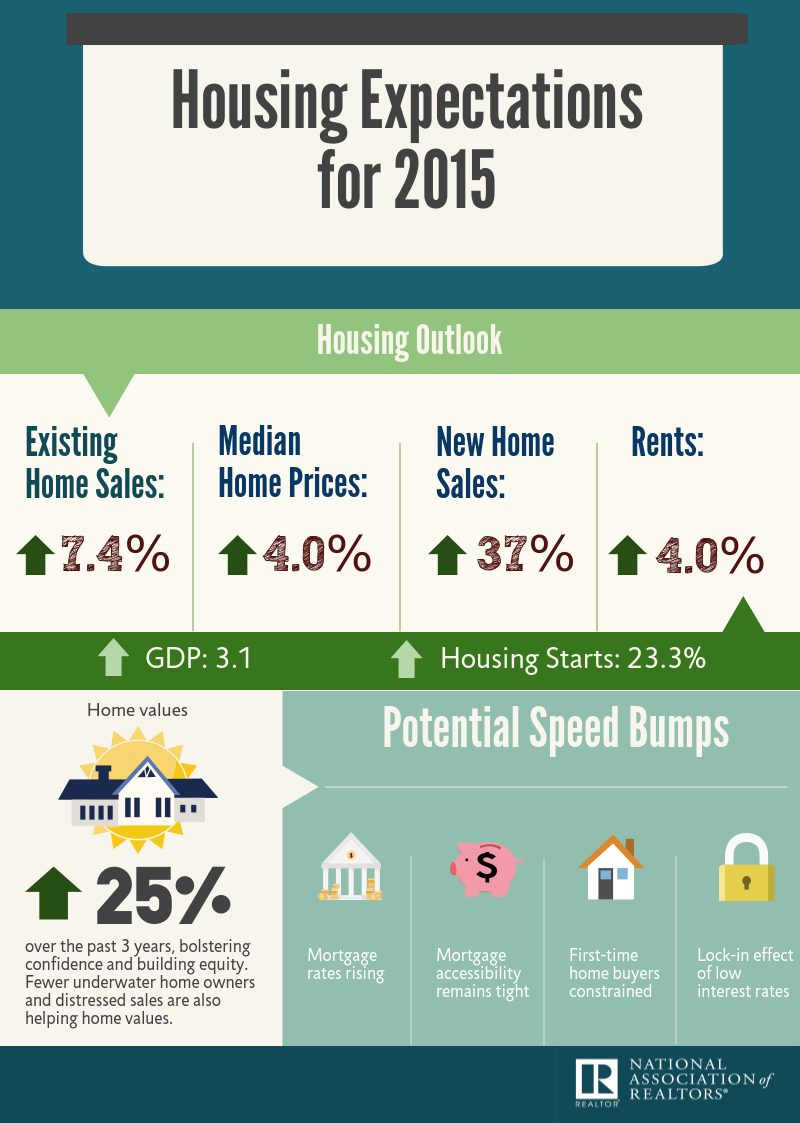

Housing Expectations for 2015

Infographic: Housing Expectations for 2015

The information in this infographic comes from a video of NAR Chief Economist Lawrence Yun talking about his 2015 housing market expectations. He expects existing-home sales to rise about 7 percent in 2015 behind a strengthening economy, solid job gains and a healthy increase in home prices.

Watch the video of Lawrence Yun's forecast.

Read the news release about Lawrence Yun's forecast.

Tuesday, March 3, 2015

This Month in Real Estate March 2015

Contact me today with all your real estate needs. Tiffany Neri- Realtor Cell: 303-775-7508

Email: tiffanymneri@gmail.com Website: www.tiffanyneri.kwrealty.com

Email: tiffanymneri@gmail.com Website: www.tiffanyneri.kwrealty.com

Thursday, February 26, 2015

Wednesday, February 18, 2015

Thursday, February 12, 2015

Monday, February 9, 2015

January 2015 Real Estate Market Report

Wednesday, February 4, 2015

This Month in Real Estate February 2015 (US)

Contact me today with all your real estate needs!

Tiffany Neri Cell:303-775-7508 Email: tiffanymneri@gmail.com

Websites: www.tiffanynerirealtor.com www.tiffanyneri.kwrealty.com

Tiffany Neri Cell:303-775-7508 Email: tiffanymneri@gmail.com

Websites: www.tiffanynerirealtor.com www.tiffanyneri.kwrealty.com

Tuesday, January 27, 2015

December 2013 vs December 2014

Are you thinking about selling your home or buying a new home in 2015?

Lets work together in achieving that goal!

Tiffany Neri- Realtor Cell: 303-775-7508 Email: tiffanymneri@gmail.com

Tuesday, January 20, 2015

Thursday, January 8, 2015

FHA to lower cost of mortgage insureance

Are you considering buying a new home, downsizing or moving up? Contact me today so we can start your search together. Tiffany Neri Keller Williams Realtor

Phone: 303-775-7508 Email: tiffanymneri@gmail.com

Websites: www.tiffanynerirealtor.com www.tiffanyneri.kwrealty.com

FHA to lower cost of mortgage insurance

January 7, 2015 2:27 Pm

In a move designed to bring more first-time home buyers into the housing market, President Barack Obama said Wednesday the Federal Housing Administration (FHA), the government insurer of home loans, will lower its annual insurance premiums from 1.35 percent to 0.85 percent.

In a statement, the White House said the move was part of the president's efforts `"to expand responsible lending to creditworthy borrowers.'' The president is scheduled to talk about improvements in the housing market at a speech on Thursday in Phoenix, one of the hardest-hit markets of the housing crash.

Stocks of the nation's home builders rose on the news Wednesday, while those of mortgage insurers fell.

"This action will make home ownership more affordable for over two million Americans in the next three years," said Julián Castro, U.S. Department of Housing and Urban Development Secretary. "Since 2009, the Obama administration has taken bold steps to reduce risks in the mortgage market and to protect consumers. These efforts have made it possible to take this prudent measure while also ensuring FHA remains on a positive financial trajectory. By bringing our premiums down, we're helping folks lift themselves up so they can open new doors of opportunity and strengthen their financial futures."

Mortgage bankers praised the decision. "It couldn't come at a better time," said David Stevens, CEO of the Mortgage Bankers Association. "February is the beginning of the spring market. I think it will have a definitive impact particularly in the first-time homebuyer market."

For the typical FHA applicant, the reduction in premiums means a savings of about $80 on their monthly payment, according to CoreLogic's chief economist, Sam Khater.

"So it's positive news from a consumer welfare perspective, especially for first-time homebuyers, which account for the majority of FHA's business," he said, adding, "However, I think the marginal impact on sales will be small because potential buyers make the decision to purchase based on trigger events, such as a new job, marriage, kids, etc. Changes in affordability only impact how much home they can buy."

The FHA had been the only low down payment product available, with a minimum 3.5 percent down, but recently Fannie Mae and Freddie Mac announced a new 3 percent down payment product that would require private mortgage insurance. The product would compete directly with the FHA and could have offered some borrowers a cheaper option if they had a good credit score.

"We believe the cut is strategic. Our view is that FHA was at risk of losing enough market share—especially of higher-quality borrowers—to the GSE 97 percent down mortgage that it could have put at risk the ability of the FHA fund to reach its 200 basis point reserve requirement this year as it had forecast. By cutting the premium, FHA would increase its share of the market and should be back on track to meeting the reserve requirement despite the cut in revenue," wrote Jaret Seiberg, an analyst at Guggenheim Partners.

The reduction will likely come under scrutiny by some on Capitol Hill, as the FHA is still building its capital reserves and is not yet above the mandatory 2 percent minimum. It is back in the black, after having bled cash for two years.

The FHA's volume had soared at the beginning of the housing crash, making up for the lack of credit in the private market, but that came at a price. In order to rebuild its fund, it more than doubled its annual insurance premium and raised average credit scores. That made it harder for borrowers today to afford an FHA loan.

Lowering the premium will bring volume back to the FHA, but it will also bring back risk.

"That is clearly the tension with any lending program that encourages low down payment," said Stevens. "But we are in a different position. We are clearly in an environment where home prices are very stable with steady growth. You don't have the dynamics to create any type of housing bubble."

Mortgage volume has been lagging, even with interest rates falling to near record lows. The Obama administration is clearly looking for new ways to boost homeownership, as investor activity wanes and the market is left to mortgage-dependent buyers.

"Now that we've made it harder for reckless buyers to buy homes that they can't afford, let's make it a little bit easier for qualified buyers to buy the homes that they can afford," said Obama in an August 2013 speech, also in Phoenix. At the time he did not make mention of the FHA, which was still in the red, but instead touted refinance programs and less red tape for lenders.

Obama is also expected to address the issue of putbacks at the FHA, which is when lenders are forced to buy back bad loans. The regulator of Fannie Mae and Freddie Mac, the Federal Housing Finance Agency, has already sought to clarify these rules, which have created huge costs for lenders and consequently higher costs for borrowers.

UPDATE: This story was updated to include the White House confirmation of lower mortgage premiums and comments from HUD Secretary Julian Castro.

Subscribe to:

Posts (Atom)

.jpg)